The Blond Group has a solid track record of completing a wide range of specialist primary research, delivering comprehensive analysis and robust recommendations.

While some research and market insights remain client confidential, other work is published for a wider audience. We welcome feedback on any of the issued raised and stand ready to discuss any specific assignments you may have.

The Journey Continues (with bumps on the road!)

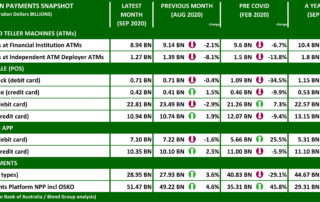

During the year I have reported on several of the monthly statistical updates provided by the Reserve Bank of Australia. With the data for September 2020 just published, I thought it timely to update the earlier numbers and see what sense can be made of the data.Turning to cash first, the dual role of currency both as a store of wealth and means of payment has never been more apparent, as the numbers that report cash on issue and cash use remain dramatically different.Headline cash on issue – perhaps a better term than cash in circulation, as clearly large volumes of cash are being held and not circulated – continue to break month on month records, with the value of Australian Dollar banknotes reaching almost $96.5billion at the end of October 2020, a more [...]

The NGB ‘family’ complete

Today (Thursday 29th of October 2020) see the general release of the fifth and final Australian Dollar banknote denomination in the Reserve Bank of Australia’s Next Generation Banknote (NGB) series. The programme was first publicly announced by the Central Bank in 2012, although initiated internally as far back as 2007 and has seen the annual release of a new polymer banknote denomination, starting with the lowest value NGB $5 banknote in September 2016. The banknotes comprise a ‘family’ of five notes, retaining the Head of State and famous Australians featured on the previous first polymer banknote series. This second series has introduced a clear top to bottom window and a unified range of sophisticated security features for both easy public recognition and advanced equipment authentication. The top to bottom window, supported by the [...]

A long road to recovery

[/fusion_builder_column] A few days ago I wrote of the news that Australian Dollar banknotes on issue at the end of June 2020 reached a new record high of $90.1 billion, an increase of just over $2billion on May 2020 and more than $10 billion higher than at the end of June 2019, that’s a 12.6% year on year increase. Despite the time lag – the payments figures just reported by the Reserve Bank of Australia are for activity in the month of May – the stellar cash circulation figures contrast starkly with the much weaker cash transaction numbers. Cash use in Australia has a long and uncertain road to recovery. This can also be said of other payment methods, as well as the wider economy. So where has all the [...]

Onwards and upwards!

Despite the continued economic challenges, reduction in cash use (and for that matter all other payments) cash in circulation continues to surge reinforcing the unique role cash serves as both a means of payment and a store of wealth. Reserve Bank of Australia June 2020 month end cash in circulation statistics reveal another all time high for the value of Australian Dollars on issue at $90.1 billion, an increase of just over $2billion on May and a climb of $6.1billion from December 2019 year end. This growth is a 7.3% increase for the half year and contrasts with falls between year end and mid year in every other year of the past decade. Higher denomination banknotes ($50 and $100) again account for the [...]