A few days ago I wrote of the news that Australian Dollar banknotes on issue at the end of June 2020 reached a new record high of $90.1 billion, an increase of just over $2billion on May 2020 and more than $10 billion higher than at the end of June 2019, that’s a 12.6% year on year increase.

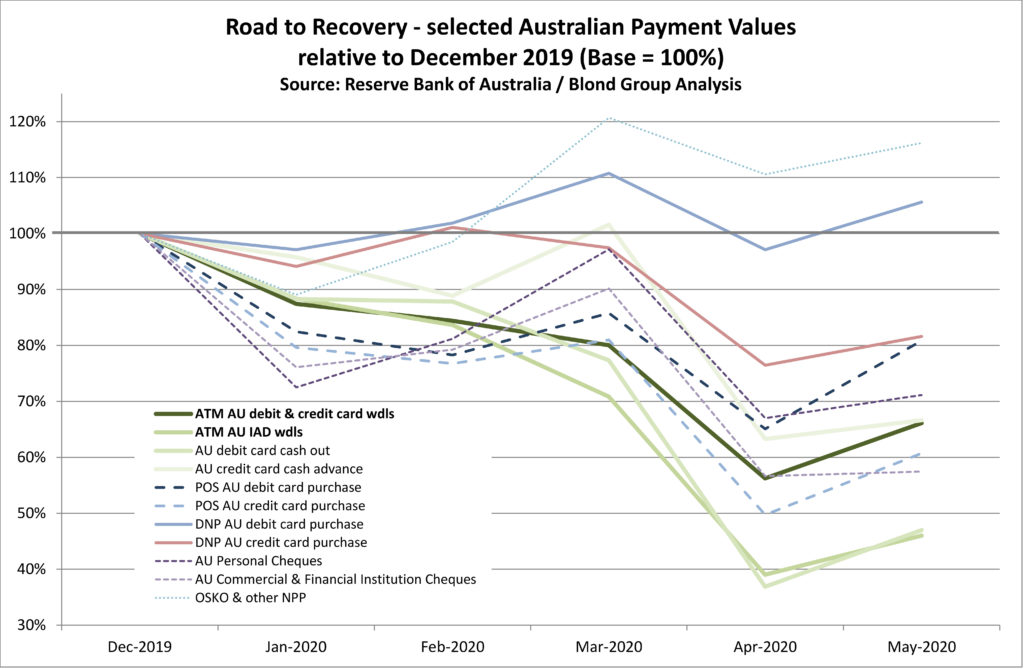

Despite the time lag – the payments figures just reported by the Reserve Bank of Australia are for activity in the month of May – the stellar cash circulation figures contrast starkly with the much weaker cash transaction numbers. Cash use in Australia has a long and uncertain road to recovery. This can also be said of other payment methods, as well as the wider economy.

So where has all the money gone? It is a complex picture, but the disconnect between what is on issue and what has been spent, suggests that cash in circulation is not really circulating, but more likely being stored at home and across the supply chain to meet potential future needs.

Lack of spending opportunity, supported by a clear shift to save, rather than spend in these uncertain times, is borne out by the changing levels of credit card indebtedness. Since December 2019, total outstanding credit card balances have fallen by nearly 20% to $40.3 billion, levels not seen since 2007. Preference for debit over credit cards, as discussed later, supports this significant move.

ATM withdrawals remain well below usual levels

While ATM transactions plummeted in late March and through April, the value of withdrawals have risen a little in May. Bank ATM withdrawals increased $1.1 billion to $7.5 billion (up 17.1%), but that’s still nearly a third less than in May last year. The number of withdrawals also increased, but not by as much as the money withdrawn, therefore taking average withdrawal values even higher, now to a record of just shy of $295 (USD 204 / EUR 181).

For Independent ATM deployers, with most of their ATMs located at or near convenience and leisure locations, ATM withdrawals were up $123 million month on month, a 17.9% increase on April 2020, but, after a much larger fall in April, nonetheless just half the levels seen a year ago.

With the phased reopening of pubs and clubs it will be interesting to see how these cash volumes recover, whether other payment forms permanently take the place of cash, or if we end up spending a little less in these locations.

While ATM cash withdrawals require a purposeful visit to a cash machine, you could argue that cash out at a retailers’ point of sale is more of a discretionary cash withdrawal and therefore perhaps more likely to be cash out for spending as opposed to storing, a little cash in hand to buy a paper, coffee, or perhaps for the kid’s pocket money (although potentially all these could and often are transacted electronically). If this is the case, then perhaps debit card cash out provide the strongest glimmer of hope for cash use. In May cash out values grew by $126 million to $582 million, up 27.5% on the previous month, albeit from a low base. In May 2019, $1,217 million was withdrawn at point of sale, so the 2020 figures are less than half!

Perhaps a good thing, growth of cash advances on credit cards was more subdued, up just 5.3% month on month to $348 million, consistent with the move to pay down credit card debt, but also possibly with fewer gaming venues enticing spending beyond ones means!

Using your debit card (or debit card enabled device) point of sale

May point of sale card (or device) based transactions increased by just over $6 billion on April. What’s revealing is the significant difference between debit card spending (linked directly to your bank account) and credit card use. Australian debit card purchases at point of sale grew by almost $4.3 billion to nearly $22 billion (up 24%), that being just shy (99.85%) of the May 2019 numbers. Contrast this to Australian credit card point of sale purchases of almost $1.8 billion, yes up 22%, but only 72% of the credit purchase levels in store a year earlier. If you add in international card present activity, down in May to just 38% of the 2019 numbers, overall point of sale values are at around 88% of their 2019 month equivalent.

Debit card proves popular in the online world as well

With social distancing, travel restrictions and lockdowns, domestic online consumer spending has remained strong. May saw month on month growth in card not present (debit and credit) transactions up $469 million and $554 million respectively. That represents debit card growth of 8.8% and credit cards up by 6.7%. The greater use of scheme debit cards online has seen debit record its largest ever share of online transactions, now accounting for nearly 40% of all such payments. While May 2020 online credit card spending was about 75% of the May 2019 figure, for debit cards, the May 2020 figure represents 115% of the previous year numbers.

Turning to international commerce, scheme debit card use has also proved strong, with May values up $109 million (19%) for the month and the May total of $681 million equivalent to 96% of the purchase made at the same time in 2019. Contrast this to credit card spending acquired internationally, up just $11 million (3%) and now at a little over half of May 2019 numbers.

Looking internationally, overseas issued cards used at Australian ATMs saw a further small decrease, down another $4 million (-2.7%), whereas Australian cards used at ATMs abroad recovered a little, up $13 million (24%), but from a very low base. The May 2020 overseas ATM use is just a fifth of that a year earlier. Australian cards used at overseas retailers’ point of sale also increased a little, but were barely more than half of what they were a year ago.

The old and the new

Cheque use was lacklustre in May with values similar to that of April. Year on year cheque values are down 47%.

In contrast, faster payments across the New Payments Platform grew by almost $2 billion in May, with other NPP enabled payments growing slightly ahead of the value of OSKO payments made.

Where do we go from here?

While the payments data gives us some fascinating insights we must remember the figures are time delayed and events surrounding the COVID-19 pandemic remain fast moving and ever changing. We expect the June numbers to reveal further improvements in cash use as pubs and clubs reopen, but at time of writing, Australia’s second largest city Melbourne, has just gone into lockdown following a spike in COVID cases and the border between New South Wales and Victoria has been closed for the first time since 1919 (to limit the spread of the Spanish Flu), so we do live in uncertain and largely uncharted times.

Will the record levels of cash in circulation end up being spent or stored in wallets, purses and bank vaults? Will credit balances continue to fall and debit cards rain triumphant, or will economic pressures force more people to resort to their credit card? Only time and the numbers will tell!