The Blond Group, an affiliate of the Internal Consulting Group (ICG) has produced a number of research publications, including the Retail Payments Innovation Global Industry Radar (GIR). Here is an extract from the Top Themes from the August 2016 edition, a full copy of which can be downloaded below.

Top Themes

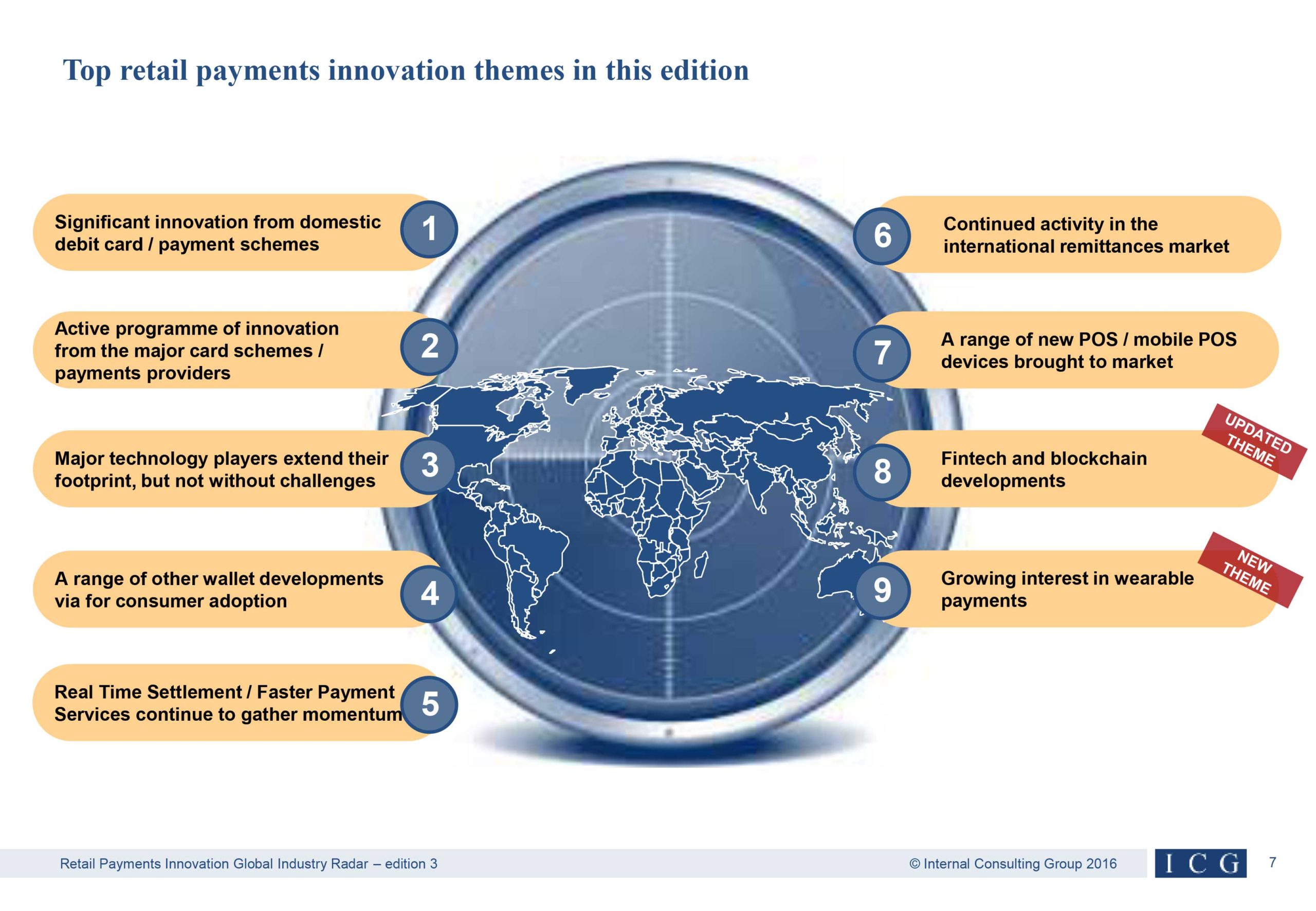

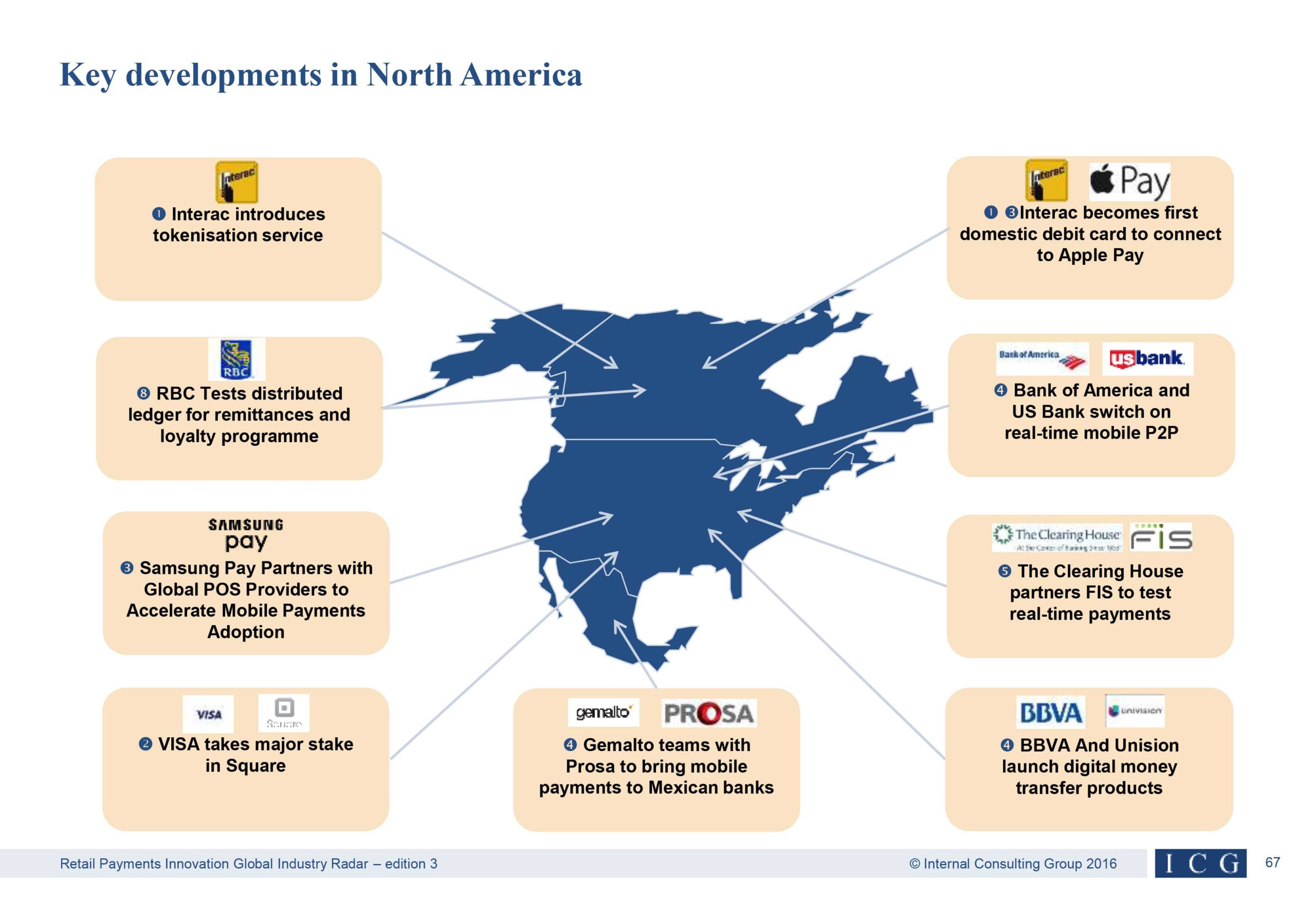

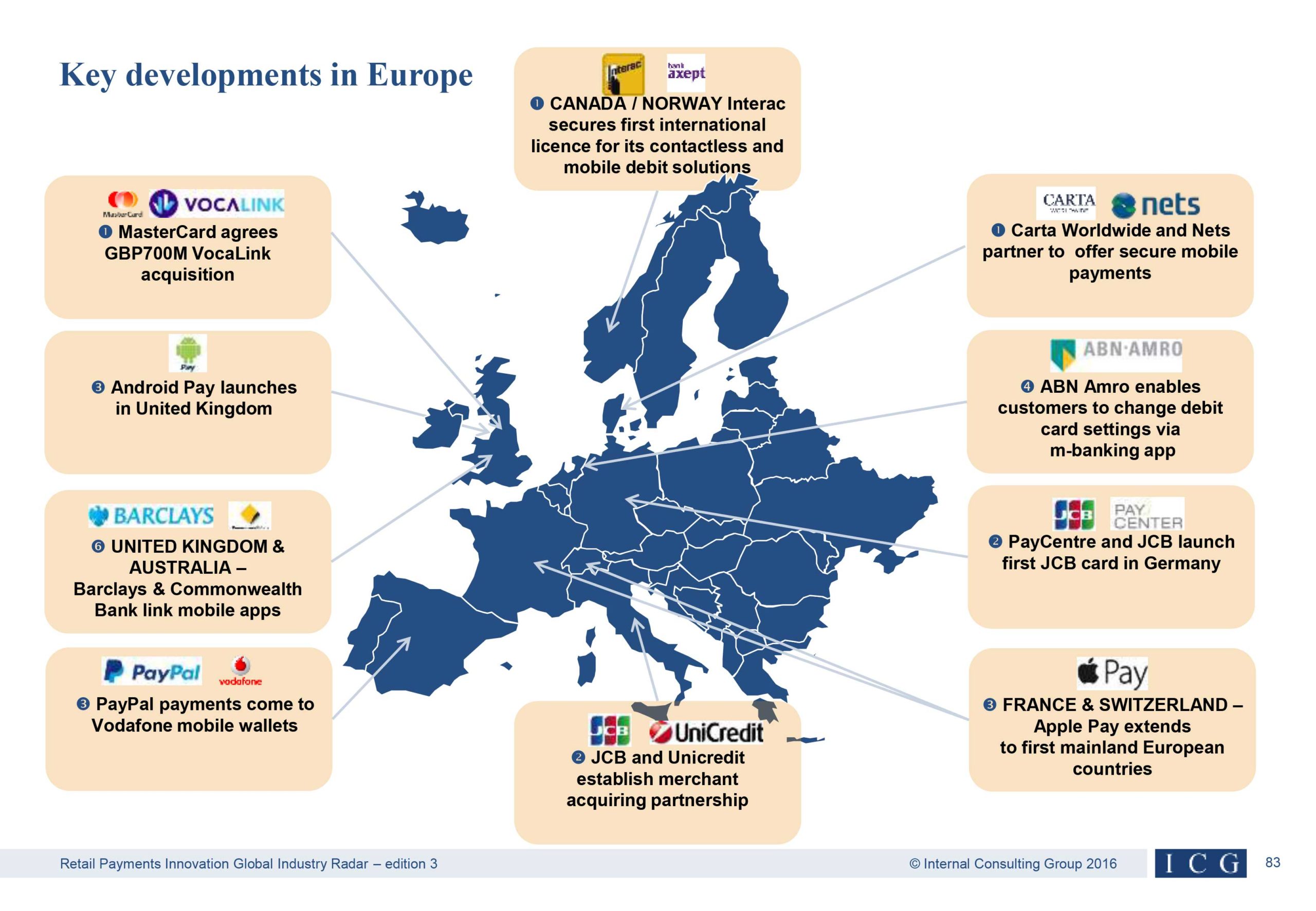

This edition of the GIR is grouped into nine top themes, seven carried over from the last edition, one updated and one new addition. We report continued significant innovation from domestic debit card and payment schemes. Notably Interac in Canada has achieved a number of domestic debit ‘firsts’ proprietary token generation and management service, being the first domestic debit scheme to be offered as part of Apple Pay and collaborating internationally with BankAxept, Norway’s domestic debit network. More worryingly we also report of the acquisition of Vocalink in the United Kingdom by MasterCard placing the international card scheme at the heart of the United Kingdom’s payments infrastructure.

The international card schemes continue to be active on many fronts and in addition to various innovations we note a number of joint ventures especially from JCB and UnionPay as they extend into many new international markets.

The first half of 2016 has also seen the continued ‘battle of the pays’ as Apple, Google and Samsung expand their international footprint, however these are not without their challenges as Apple’s limited foray into Australia shows.

Alongside the big three technology players we report on a range of other wallet developments as they via for consumer adoption in an increasingly crowded marketplace.

Real Time Settlement news also features as established markets such as the United Kingdom seek to open access to challenger and secondary players and other countries embark on their own faster payment plans.

We report continued activity in the international remittances market and highlight the recent tie up between Barclays Bank in the united Kingdom and Commonwealth Bank of Australia as they link their respective mobile banking apps in a bid to retain a share of the international remittance market that is being picked up by a number of new entrants and specialist providers.

Innovative developments in point of sale and across fintech are also features as is for the first time a series of stories about growing interest in wearable payments.

You can download a copy of the GIR here, or alternatively please get in touch for more information.